Market Snapshot: Western Canadian Natural Gas Production Reaches a Record High in 2022

Connect/Contact Us

Please send comments, questions, or suggestions for Market Snapshot topics to snapshots@cer-rec.gc.ca

Release date: 2023-03-01

Western Canadian natural gas productionFootnote 1 hit an all-time high in November 2022, averaging 17.9 billion cubic feet per day (Bcf/d). The previous record was 20 years ago, at 17.2 Bcf/d in April 2002. In fact, 2022 included at leastFootnote 2 eight of the top ten producing months since January 2000.

Early 2000s production increased, and technology improved

Production was strong in the early 2000s, because natural gas prices were reaching historical highs and U.S. demand for natural gas imports were rising at the time. The natural gas market increasingly believed that, while gas production was growing, a lot of the accessible gas resourceDefinition* was already so developed, it would struggle to supply growing North American natural gas demand in the future. Because of this belief, some companies built marine terminals, mainly in the U.S., to import liquefied natural gas (LNG)Definition* on ships from overseas. Others experimented and improved existing technology to increase gas production by learning how to better hydraulically fractureDefinition* horizontally drilled wells,Definition* which is called multi-stage hydraulic fracturing.Definition*

Figure 1: Western Canadian monthly natural gas production since 2000

Source and Description

Source: CER – Marketable Natural Gas Production in Canada.

Description: This figure shows monthly natural gas production since 2000 for British Columbia, Alberta, and Saskatchewan. It also shows the highest month of production, which is 17.9 Bcf/d in November 2022. The previous record high was 17.2 Bcf/d in April 2020. In January 2000, production for these three provinces totaled 16.4 Bcf/d. The lowest total since 2000 was 13.2 Bcf/d in July 2012.

Low-cost gas production changed U.S. exports

Around 2006 to 2008, multi-stage hydraulic fracturing started increasing tightDefinition* and shaleDefinition* natural gas production in CanadaFootnote 3, as well as shale gas and gas produced with tight oil in the U.S.Footnote 4 As of 2022, gas production is again hitting record highs in both countries. Gas production is now relatively low-cost and the gas resource so large that production could continue to grow well into the futureFootnote 5 under some scenarios. Growing low-cost gas production also caused several U.S. LNG import terminals to convert to LNG export terminals, increasing exports of LNGFootnote 6 from the U.S. and making it the largest LNG exporter in the world in 2022Footnote 7.

Tight gas production has increased in western Canada

Nearly all production in Canada is from Alberta and British Columbia (B.C.). Both provinces have increasing shares of tight gas production.Footnote 8 Production increases have also been supported by increasing demand over the last two decades,Footnote 9 particularly from the oil sands and for power generationFootnote 10 in Alberta. Future production growth could be supported by rising gas demand from hydrogen, ammonia production, and LNG exports.

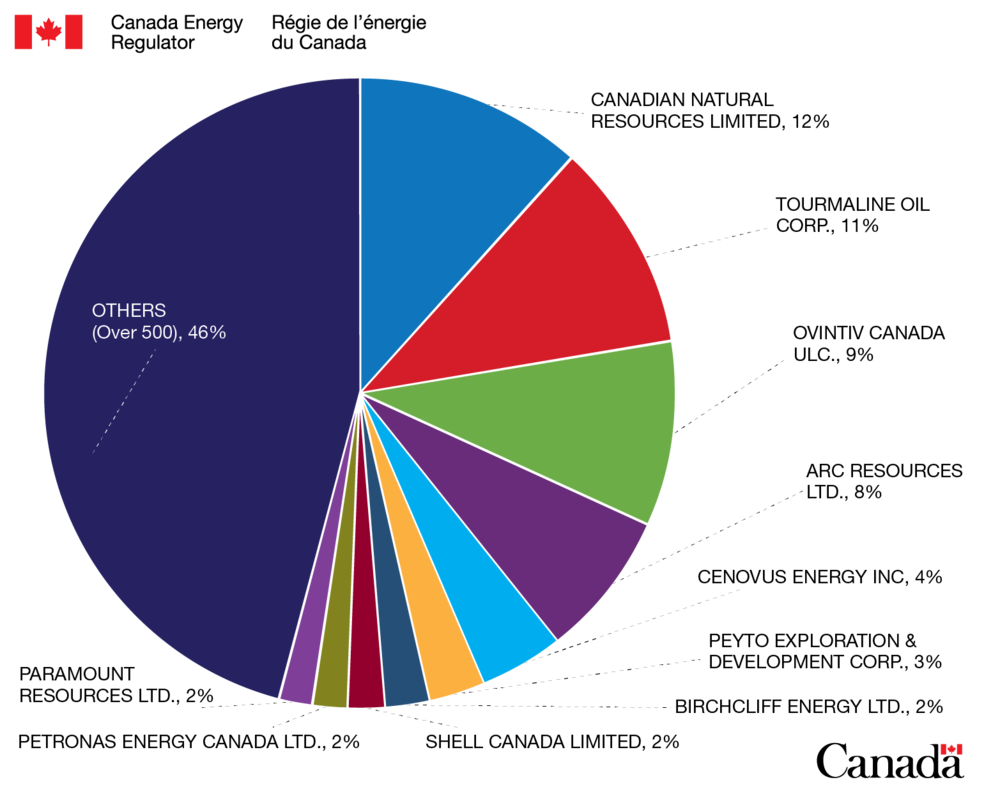

Production costs limit most production to a few companies

In 2021, around 540 companies operatedFootnote 11 natural gas production wells in western Canada. However, more than half of production in 2021 came from only eight operators. The top operators are listed in figure 2 below. Most tight and shale gas wells are more expensive to own, because they are deeper, have long horizontal legs, and because multi-stage fracturing is expensive. Smaller operators generally cannot afford to drill or buy these more costly new wells, and as a result, only a few companies operate most of the production. Smaller companies in western Canada tend to own relatively inexpensive vertical gas wells and have fairly small production volumes. In general, the more expensive wells result in much higher volumes of production, making the cost per unit of gas production from expensive wells much lower than gas production from inexpensive wells.

Figure 2: Western Canadian natural gas production shares by gas operator in 2021

Source and Description

Source: Well data from Divestco.

Description: This pie chart shows production shares by gas operator in 2021. It lists the top ten operators individually, then groups the others together. The top ten operators accounted for 54% of production in 2021, and over 500 other operators accounted for the remaining 46% of production. The top operators were, from largest to smallest, Canadian Natural Resources, Tourmaline Oil, Ovintiv Canada, Arc Resources, Cenovus Energy, Peyto Exploration and Development, Birchcliff Energy, Shell Canada, Petronas Energy Canada, and Paramount Resources.

- Date modified: